Financial Assistant: Directing You In The Direction Of Your Monetary Goals

Wiki Article

Streamline Your Financial Trip With Relied On and Reliable Loan Providers

In the realm of personal finance, browsing the myriad of financing choices can commonly feel like an overwhelming job. When geared up with the right devices and assistance, the journey in the direction of protecting a lending can be streamlined and stress-free. Trusted and efficient lending solutions play an essential role in this procedure, using individuals a reputable path towards their economic goals. By comprehending the benefits of collaborating with reliable lenders, exploring the different kinds of finance services readily available, and honing in on essential aspects that determine the appropriate fit for your demands, the course to financial empowerment ends up being clearer. Yet, truth essence exists in how these services can be leveraged to not only protected funds yet likewise to optimize your monetary trajectory.Advantages of Relied On Lenders

When looking for monetary assistance, the advantages of choosing relied on loan providers are extremely important for a protected and trustworthy borrowing experience. Relied on loan providers provide openness in their conditions, offering debtors with a clear understanding of their commitments. By functioning with credible lending institutions, debtors can prevent concealed charges or predacious methods that could result in economic mistakes.Moreover, trusted lenders typically have established relationships with regulatory bodies, making sure that they run within legal borders and follow industry standards. This compliance not only safeguards the customer however additionally promotes a feeling of count on and reliability in the borrowing procedure.

Furthermore, reliable lenders prioritize customer care, providing support and support throughout the borrowing journey. Whether it's making clear loan terms or aiding with repayment options, relied on lending institutions are committed to helping customers make knowledgeable monetary decisions.

Kinds Of Financing Provider Available

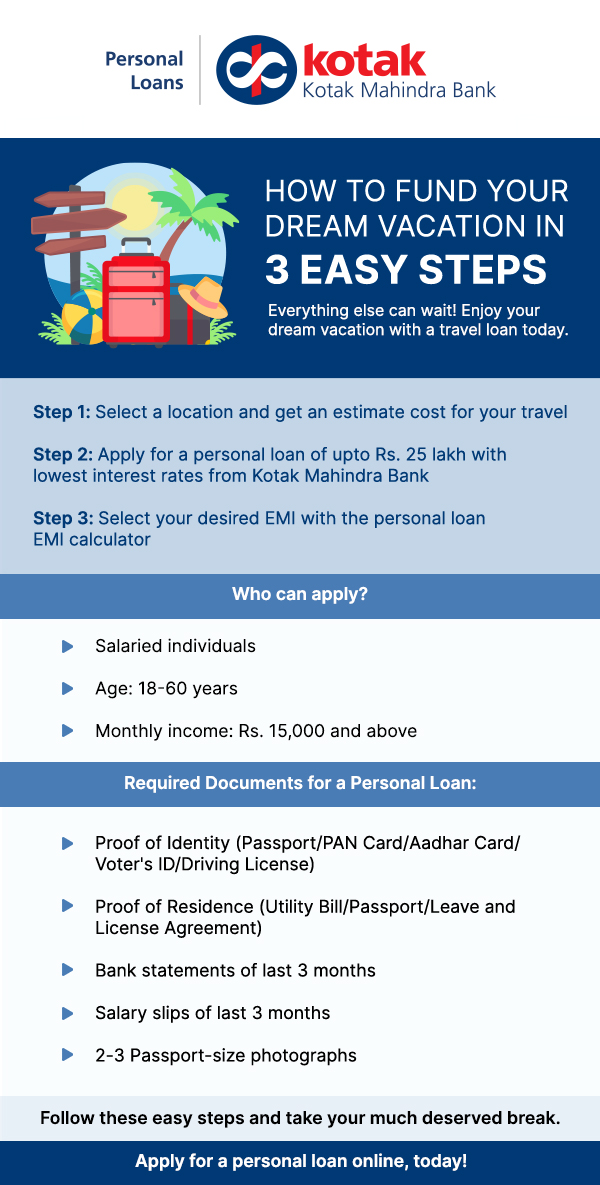

Numerous financial establishments and loaning companies supply a diverse range of finance services to provide to the differing demands of customers. Some of the usual types of car loan solutions offered consist of individual car loans, which are typically unprotected and can be used for different purposes such as financial obligation combination, home improvements, or unexpected expenses. Comprehending the different types of funding services can help customers make notified decisions based on their details financial requirements and objectives.Elements for Picking the Right Car Loan

Having familiarized oneself with the varied variety of financing solutions offered, debtors should carefully evaluate essential elements to select one of the most appropriate loan for their specific economic requirements and goals. One vital factor to take into consideration is the rate of interest, as it straight influences the total quantity paid off over the funding term. Consumers must compare rate of interest from various loan providers to secure one of the most competitive alternative. Loan terms also play an essential function in decision-making. Recognizing the repayment timetable, charges, and fines connected with the funding is vital to stay clear of any type of surprises in the future.Additionally, customers need to evaluate their existing financial circumstance and future potential customers to establish the loan amount they can conveniently afford. It is suggested to borrow only what is necessary to reduce the monetary burden. In addition, assessing the loan provider's online reputation, customer support, and overall openness can add to a smoother loaning experience. By very carefully thinking about these elements, consumers can choose the appropriate funding that straightens with their economic objectives and capabilities.

Streamlining the Finance Application Process

Effectiveness in the car loan application procedure is extremely important for making sure a smooth and expedited loaning experience. To streamline the funding application procedure, it is vital to offer clear assistance to applicants on the called for paperwork and information - Financial Assistant. Using on the internet platforms for application entries can dramatically lower the moment and effort included in the process. Applying automated systems for confirmation of papers and debt checks can speed up the application evaluation procedure. Using pre-qualification options based upon fundamental info offered by the candidate can aid in removing ineligible prospects early on. Supplying routine updates to candidates on the standing of their application can boost transparency and consumer fulfillment. Moreover, streamlining the language utilized in application and interaction products can assist in far better understanding for candidates. By incorporating these structured processes, funding companies can offer a more efficient and straightforward experience to debtors, inevitably boosting general client complete satisfaction and commitment.

Tips for Successful Loan Settlement

Prioritize your finance settlements to prevent skipping on any type of lendings, as this can adversely impact your credit report score and financial stability. In instance of economic difficulties, interact with your loan provider to check out possible options such as car loan restructuring or deferment. By staying organized, positive, and financially disciplined, you can effectively navigate the process of repaying your financings and accomplish greater financial freedom.Final Thought

In verdict, utilizing relied on and effective finance services can significantly simplify your economic trip. click here to read By very carefully picking the ideal loan provider and type of loan, and streamlining the application process, you can ensure a successful borrowing experience.Report this wiki page